Most business owners feel a sense of relief when they hear, “Insurance will cover it.”

And eventually, it probably will.

But experienced operators know the check is never the end of the story. In many cases, it is just the beginning of the real cost.

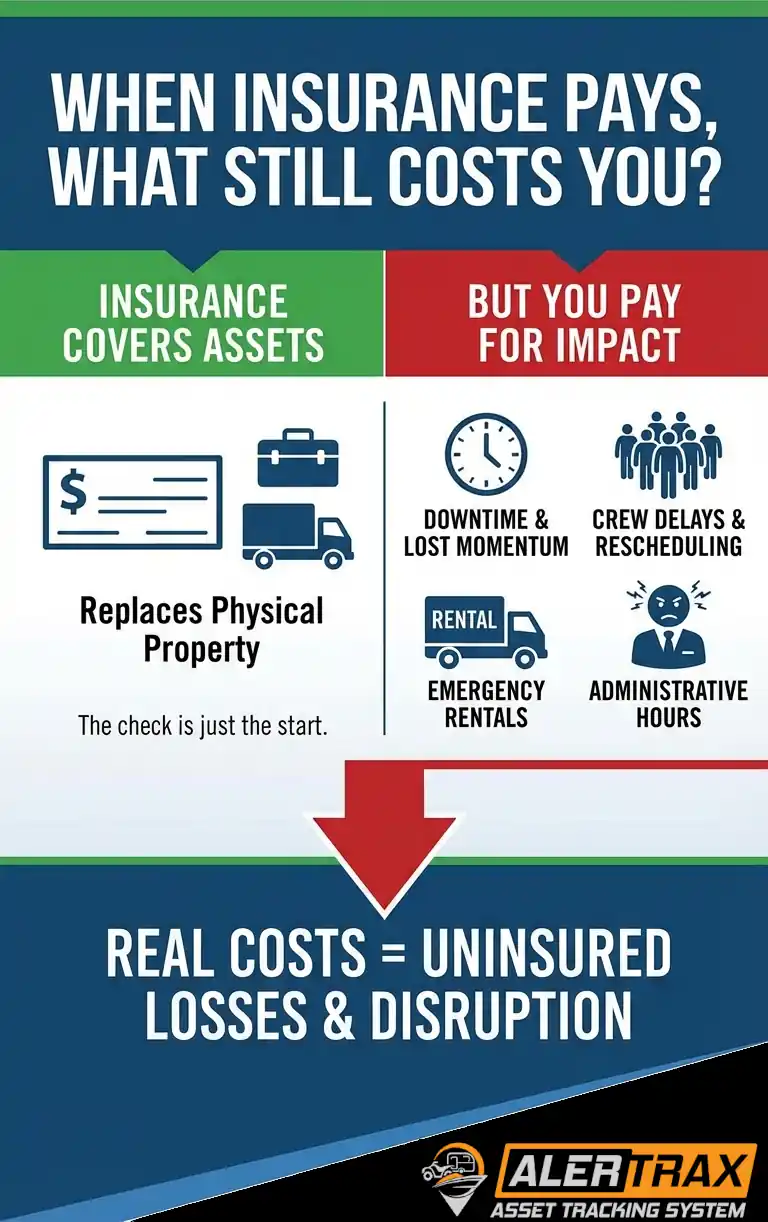

Insurance Covers Assets. Not Impact.

Insurance is designed to replace physical property. It is not designed to protect your schedule, your crews, or your cash flow.

Once a trailer or vehicle is stolen, the clock starts running on a series of losses that never appear on the claim form.

Those losses are paid by you.

The Costs That Start Immediately

The moment equipment goes missing, several things happen at once :

- Jobs are delayed or rescheduled

- Crews are reassigned or sent home

- Emergency rentals are sourced at premium rates

- Managers shift focus from growth to damage control

Even a short disruption can ripple across multiple jobsites.

Insurance does not reimburse lost momentum.

Deductibles Are Just the Entry Fee

Most owners focus on the deductible because it is the most obvious out-of-pocket cost.

But it is rarely the largest.

By the time a claim is settled, many businesses have already absorbed :

- Overtime to recover schedules

- Rental fees to stay operational

- Missed deadlines and strained client relationships

- Hours of administrative time with police and insurers

None of this is optional. All of it pulls resources away from revenue-generating work.

Downtime Is the Quiet Margin Killer

The most expensive line item after a theft is often downtime.

Crews waiting on equipment still get paid. Jobs pushed back create scheduling conflicts. New work may be delayed because capacity is tied up.

These costs are hard to quantify, which is why they are often underestimated.

But over a year, they quietly erode profit.

Repeat Claims Raise New Questions

Multiple theft claims do more than raise premiums.

They can:

- Trigger closer scrutiny from insurers

- Increase deductibles at renewal

- Limit coverage options

- Require additional documentation and controls

At a certain point, insurance stops feeling like protection and starts feeling like friction.

The Assumption That Creates Risk

Many businesses operate under this belief:

“If something happens, insurance will handle it.”

That mindset treats theft as a financial event instead of an operational one.

The businesses that suffer the least are not the ones with the best policies. They are the ones that reduce the chance of a loss turning into a prolonged disruption.

The Better Question to Ask

Instead of asking, “Will insurance pay?”

Ask this:

How much does a theft cost us before insurance ever gets involved?

For most multi-trailer operations, the answer is uncomfortably high.

Prevention Changes the Math

Early detection and recovery do not just protect the asset. They protect the workflow around it.

The faster you know something is wrong, the more options you have:

- Respond before equipment disappears

- Reduce downtime

- Avoid rentals and rescheduling

- Keep insurance as a backstop, not a plan

Insurance should be the last line of defense, not the first.

Protect More Than the Trailer

If you are managing multiple trailers or vehicles, the real risk is not just replacement cost. It is interruption.

AlerTrax helps you detect movement early so problems are addressed before they become claims. You can choose a $599 one-and-done purchase for long-term protection, or get started for just $99 upfront on a monthly plan.

If insurance paying is not enough, it may be time to focus on preventing the loss in the first place.